Leonidovich/iStock by using Getty Photographs

AppHarvest (NASDAQ:APPH) had very bold goals when it went general public early final yr and announced its plans to develop a single of the greatest controlled surroundings agriculture services in the United States. The 60-acre Morehead, Kentucky greenhouse is expanding 45 million lbs . of tomatoes a calendar year and is the initially of quite a few services planned. It was intended to enable AppHarvest to arrive at its aim of $25 million in net revenue for 2021, rising to $59 million in 2022. The buzz was tangible and at a press function to commemorate Morehead’s opening, CEO Jonathan Webb announced how AppHarvest was “right here to shock the planet”. I last included AppHarvest at the finish of 2021, exactly where I try out to go around the main factors AppHarvest’s solution to agriculture is greater than the standing quo.

Traders rightly bought swept up in the dream of switching US farming for the superior. Without a doubt, the profit of controlled setting agriculture then as it is now is clear improve additional meals with less resources and do it nearer to wherever the meals is eaten.

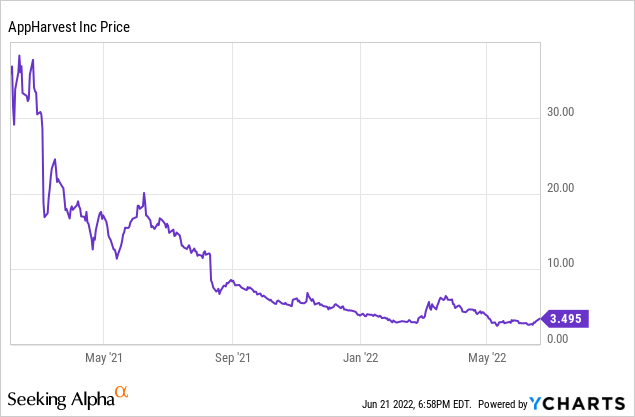

Now more than a 12 months given that the business went community, its prevalent shares are having difficulties possessing collapsed much more than 90% from highs of $35. Even further, with full revenues for its fiscal 2021 inevitably coming in fewer than 50% lessen than assistance and recent fiscal 2022 profits also monitoring reduce on a quarterly basis, AppHarvest’s revolution appears to be to have been thrown into doubt.

This comes towards speedily rising commodity selling prices as Russia’s war versus Ukraine has established off world wide offer chain disruption and multi-10 years inflation highs. This has injected even more uncertainty into a food items system that is continue to recovering from the pandemic.

Listed here To Shock America And The Earth

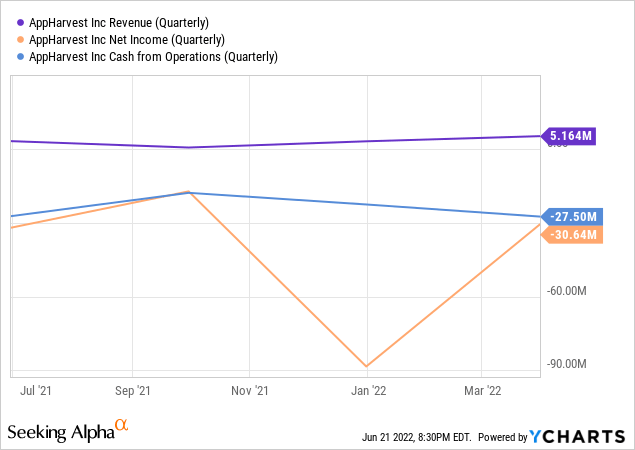

The company’s battling share value and dwindling liquidity have occur as a shock to extended-expression traders chasing the guarantee held by growing foods indoors. With initially supplied assistance all but absent, AppHarvest’s very last released earnings for its fiscal 2022 initial quarter observed revenue appear in at $5.2 million. This was a 126.1% 12 months-above-year raise but a pass up by $200,000 on consensus estimates. Growth was driven by an 82% 12 months-over-year maximize in yield from 3.8 million lbs to 6.9 million lbs. The net promoting selling price per lb also increased by 23% to $.75.

Internet decline was high at $27.5 million with money loss from operations at $30.64 million. The corporation expects to be in a position to generate leafy greens and berries in the in close proximity to upcoming with a few new services planned for 2022. This will also see the addition of a further 60 acres tomato develop facility in Richmond, Kentucky.

AppHarvest reaffirmed its new fiscal 2022 internet earnings steerage of $24 million to $32 million. This really should be far more than double 2021’s internet revenue. Even so, losses are still envisioned to be high with non-GAAP modified EBITDA envisioned to be in the variety of $70 million to $80 million. The firm is also anticipated to maintain Capex at its large variety to entire the make out of its new progress amenities. This was at $39 million in the course of its very last noted quarter from cash and equivalents that experienced declined to access $97.6 million from $150.8 million in the preceding quarter. Essentially, the resiliency of AppHarvest is being challenged and raising money in the present-day weather may possibly prove tricky and much more pricey than it would have if not been. I will not consider AppHarvest faces a heading problem issue as it held roughly $58 million in untapped credit score facilities and also established a $100 million dedicated fairness facility. But a protracted dearth of funding options on the again of a collapsed inventory industry and a world-wide recession could direct to work cuts and prioritisation of prepared Capex.

It truly is Time To Expand

The present crash of AppHarvest shares does not imply that need for tomatoes from domestic sources has out of the blue disappeared. The previous valuation, like many other corporations that went general public by using SPAC at the time, was driven by surplus liquidity conditions and unfettered trader euphoria. AppHarvest proceeds to remain at the vanguard of the shift in direction of a much more sustainable strategy of farming. A requirement in a world dealing with considerable inhabitants progress charges even though beset by the uncertainties of weather improve.

The fragile US meals system was highlighted by the pandemic as globalized offer chains buckled underneath force and countrywide governments prioritized their possess populations. Consequently, the essential have to have for a domestic offer chain has by no means been clearer. This circumstance has been exacerbated by the latest geopolitical local weather.

When people work alongside one another fantastic things occur. And AppHarvest is a fantastic thing and an crucial company chasing a industry that will be vital in a additional unstable and unstructured world most likely to be beset by consecutive unparalleled challenges. So outside of a need to have to develop more foods with less assets, AppHarvest opens a incredibly wanted orthodoxy of self-reliance and foods stability. In this the Appalachian agricultural revolution troopers on. The stock is a purchase on a lot more clarity on management on extensive-time period financing against their latest facility create-out system and income burn up.