Jay Yuno/E+ by means of Getty Images

By Ryan Koory

A spectacular transformation of the foods market, pushed by a beautiful array of consumer selections, has taken position above the past 30 a long time.

Think about going for walks the dairy aisle in 1990 in contrast to 2022. Possibilities have expanded beyond the selection of basically ‘whole vs. skim milk’ to incorporate organic milk, grass-fed milk, an array of plant-based mostly milks, lactose-cost-free milk… and the list goes on. This workout can be recurring on virtually any aisle, with products and solutions from coffee to eggs to meat.

After viewed as a fad in just the broader agriculture market, persistent advancement led by increasing client demand from customers has set up U.S. organic agriculture’s put at the table.

In accordance to facts generated by the U.S. Organic and natural Trade Association (OTA), U.S. organic sales achieved practically $62 billion in 2020 as the market obtained its 12th consecutive calendar year of development. Organic foodstuff profits on your own eclipsed $56 billion, accounting for far more than 3% of all U.S. food expenses. Within just particular classes, like dairy and some clean vegetables, organic and natural market share has approached or exceeded double digits.

Following escalating consumer demand, the footprint of U.S. natural agriculture has expanded. According to natural and organic value reporting agency Mercaris’ estimates, the quantity of U.S. qualified natural and organic acres reached 9.1 million in 2021, which signifies a 123% maximize from the Section of Agriculture’s Financial Investigate Provider 2008 estimate. This period has also viewed natural dairy cow inventories increase 164%, with 2021 yr-close inventories reaching 532,000 heads, for each Mercaris’ estimates. When historical info for 2008 does not exist for poultry manufacturing, the offered info implies equally strong advancement. For every USDA Agricultural Internet marketing Service knowledge, natural and organic turkey and broiler slaughter greater 303% and 150%, respectively, from 2011 by 2021, whilst cage-absolutely free natural and organic egg layer inventories amplified 125% from 2014 by means of 2021.

While development in U.S. organic and natural manufacturing has been extraordinary, it has not been without growing pains.

Source Chain Hazards

On a single hand, natural commodities marketplaces are just that – marketplaces that are subject to the pressures of offer and demand. On the other hand, the relative lack of transparency, thinness of the marketplaces themselves, and rate of expansion all merge to amplify pitfalls for everybody, from producers to consumer-packaged goods providers.

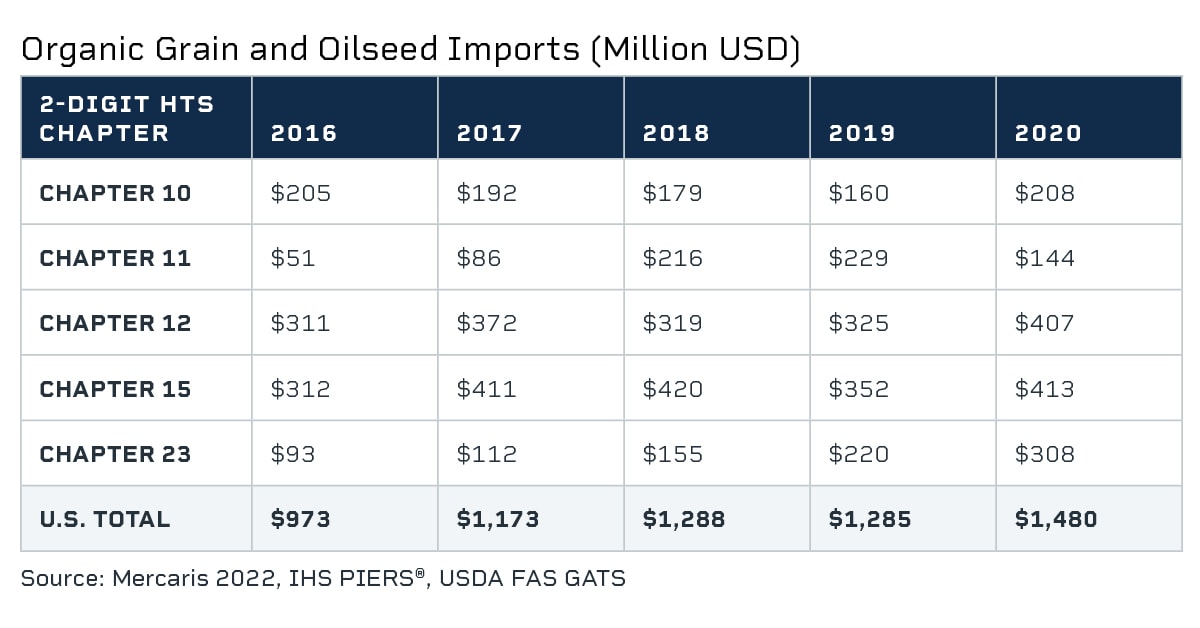

Just one of these features has been a considerable maximize in U.S. imports, especially of natural grains and oil seeds, mainly used as livestock and poultry feed elements. Mercaris estimates that U.S. imports of organic grains, oil seeds and their derivatives reached almost $1.5 billion in 2020, a increase of 52% from just five several years prior. When imports have performed a significant job in supporting the immediate expansion of U.S. natural and organic shopper demand, their growth has enhanced the interconnectedness of U.S. and global natural marketplaces, ushering in a new level of rate risk in these markets.

For illustration, U.S. organic soybean markets have demonstrated to be notably exposed. Attributable to the quick advancement in natural and organic poultry production, U.S. imports of natural soybeans and soybean food arrived at 241,000 MT and 427,000 MT, respectively, around the 2020/21 internet marketing yr.

By comparison, U.S. organic soybean generation reached only 226,000 MT over the exact same period. Following a cascade of trade disruptions about the earlier yr – together with organic certification reform, tariff imposition, and war inside the Black Sea location – imports of organic soybeans and soybean meal are on speed to arrive at six-12 months lows more than the 2021/22 advertising and marketing calendar year. This abrupt tightening of U.S. organic and natural soy materials has driven costs sharply increased considering that the start of 2021.

Although on the whole, the U.S. organic and natural industry continues to be reliant on international resources, parts of the industry have started to mature towards domestic self-sufficiency. For U.S. organic and natural corn marketplaces, the purpose of imports has slowly fallen above the earlier 5 several years. More than the 2020/21 promoting 12 months, U.S. imports of organic corn arrived at 291,000 MT, only a portion of the 1.2 million MT the U.S. manufactured domestically. Although this has reduced the U.S. natural and organic corn market’s publicity to foreign provide risk, it has not isolated it from other sorts of selling price volatility.

Subsequent a better-than-envisioned harvest, U.S. organic and natural corn materials surpassed desire anticipations more than the 2019/20 advertising and marketing 12 months. This plunged price ranges into a year-long bearish retraction, ultimately pressing organic corn costs to 10-year lows. Whilst the situations which precipitated the 2019/20 cost retraction have because subsided, the possible for these situations to reoccur persist. Wanting about the present-day 2021/22 advertising 12 months – with file U.S. output and expanding imports – the potential for a further bearish downturn stays.

While consumer demand has been the driver for an boost in organic and natural agricultural production for more than 20 decades, obtain to sturdy, unbiased 3rd-party information and investigation is only much more a short while ago offered. By means of private sector sources like Mercaris, as very well as confined USDA stories, these facts and insights are supporting to generate far more transparency in the area.

Editor’s Note: The summary bullets for this report have been picked by Trying to get Alpha editors.